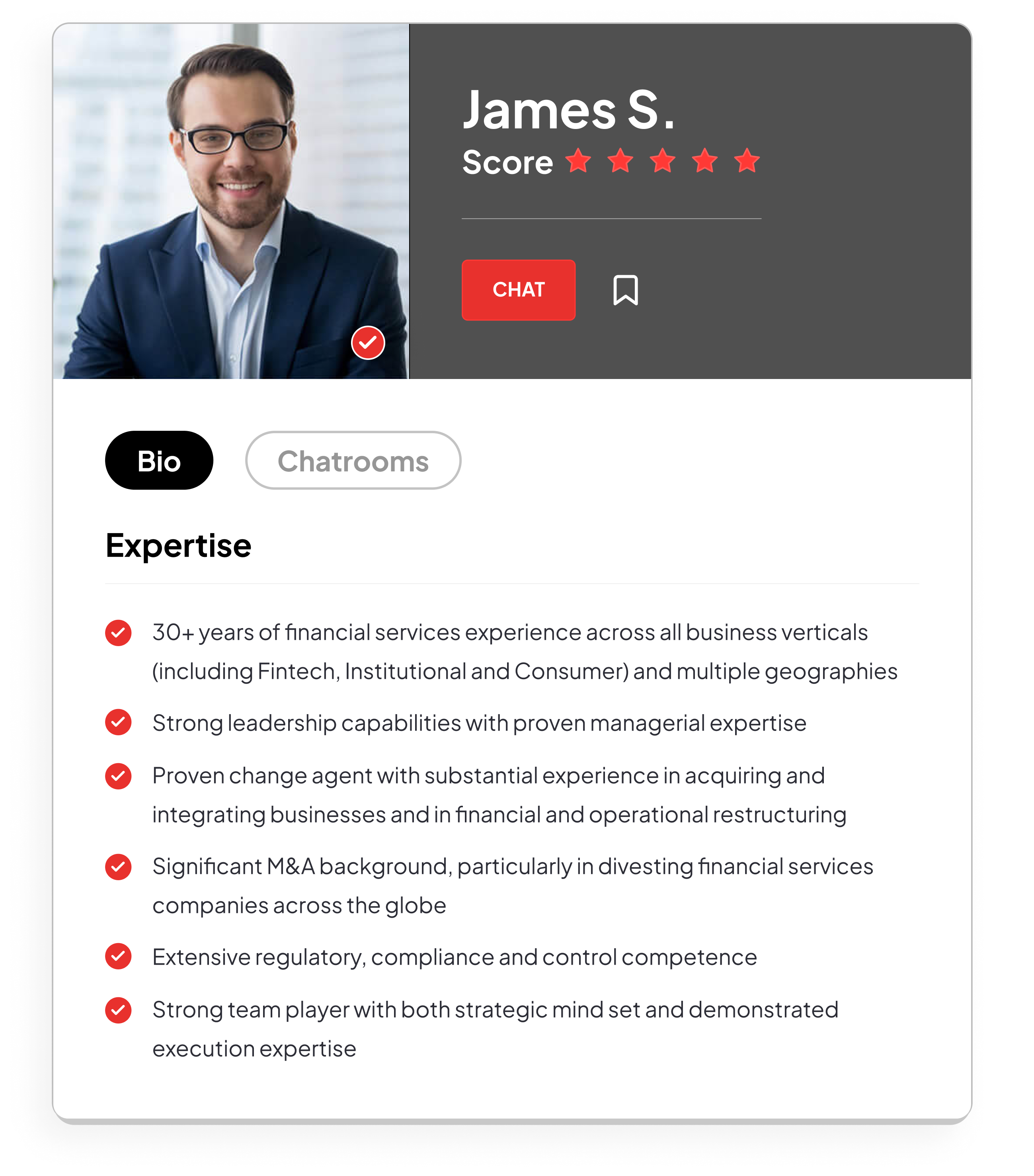

ADVISORS

Find projects and interim work with top institutions

Accelerate your visibilty and access to clients by joining our network of independent advisors

Accelerate your visibilty and access to clients by joining our network of independent advisors

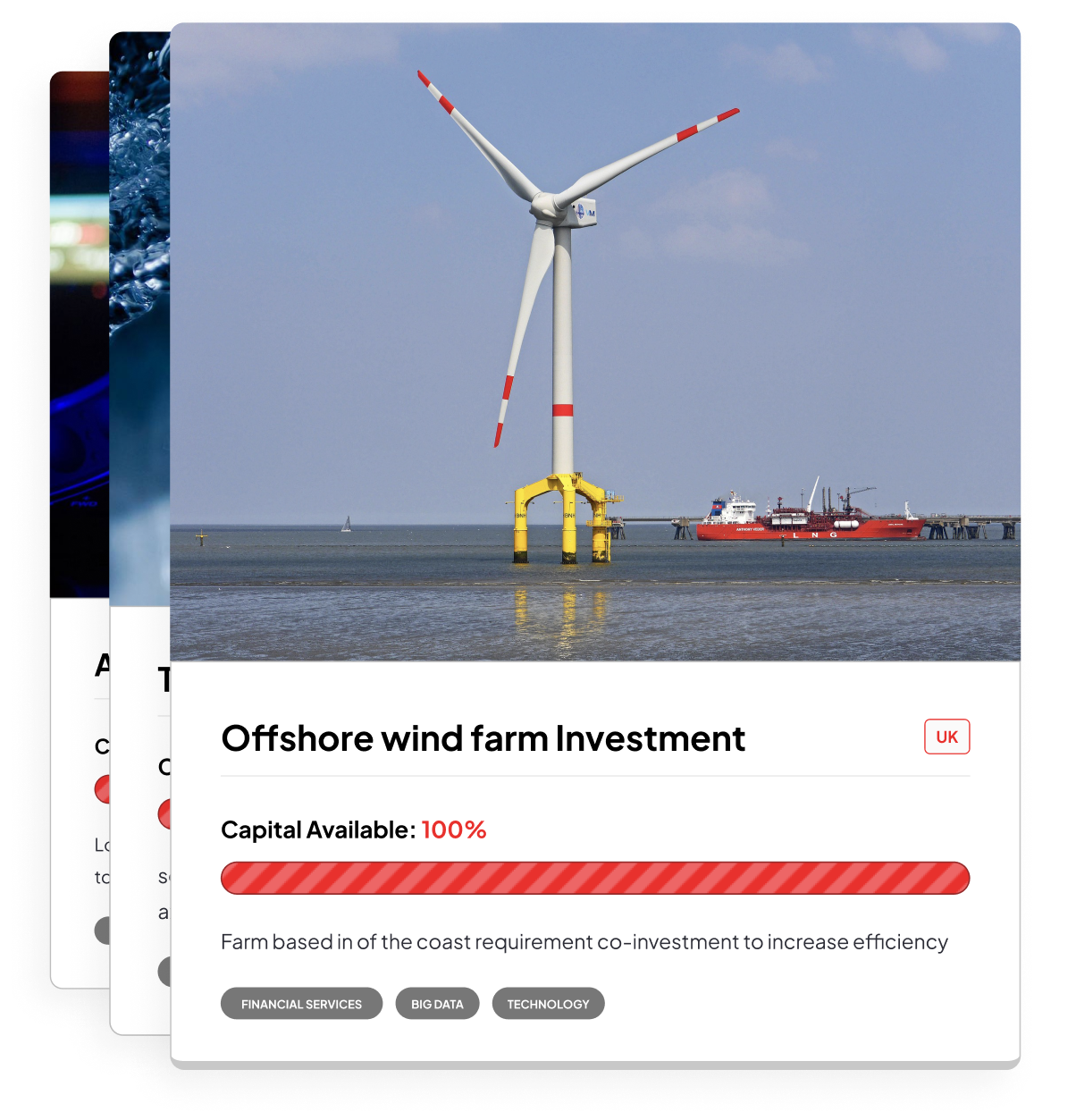

An end-to-end digital solution for your deal, enabling you to create, plan and monitor your investor outreach and deal execution all in one place, online